#MoveTheDate

Our investments shape the economy we run. If our investments, including our bank deposits, decarbonized the electricity system worldwide by 50%, we could move Earth Overshoot Day by 22 days.

What is the solution?

Bank with an institution that purposefully uses your deposits to finance the sustainability transition. Aligning your bank deposits to finance decarbonization ensures that your money is being used to create the world you want to see.

This solution improves our resource security in the energy category.

How does it #MoveTheDate?

Every dollar in your account helps reduce the carbon Footprint of humanity by financing additional solar and wind power needed to replace the fossil fuel generation in the electric grid.

How is it scalable?

The electric grid is still far from being fully renewable. As costs for solar and wind power continue to decline and become more prevalent, and as new technologies emerge, low-cost bank financing becomes one of the most important tools to distribute these technologies at scale. Targeted bank financing puts more solar on roofs, electrifies home appliances and vehicles that can reduce household operating budgets and protect against electric grid failures.

What is the solution?

Bank with an institution that purposefully uses your deposits to finance the sustainability transition. Aligning your bank deposits to finance decarbonization ensures that your money is being used to create the world you want to see.

This solution improves our resource security in the energy category.

How does it #MoveTheDate?

Every dollar in your account helps reduce the carbon Footprint of humanity by financing additional solar and wind power needed to replace the fossil fuel generation in the electric grid.

How is it scalable?

The electric grid is still far from being fully renewable. As costs for solar and wind power continue to decline and become more prevalent, and as new technologies emerge, low-cost bank financing becomes one of the most important tools to distribute these technologies at scale. Targeted bank financing puts more solar on roofs, electrifies home appliances and vehicles that can reduce household operating budgets and protect against electric grid failures.

Banking with a twist: You usually don’t get to choose what your bank does with your money. If you want your money to help #MoveTheDate, Atmos Financial is a good place to put it. This US-based digital banking provider comes with an intriguing twist. It uses its customers’ deposits to finance the transition to the clean economy for all. Conventional banks, in contrast, lend into the conventional economy… supporting all the stuff that got us here to begin with.

Banking with a twist: You usually don’t get to choose what your bank does with your money. If you want your money to help #MoveTheDate, Atmos Financial is a good place to put it. This US-based digital banking provider comes with an intriguing twist. It uses its customers’ deposits to finance the transition to the clean economy for all. Conventional banks, in contrast, lend into the conventional economy… supporting all the stuff that got us here to begin with.

Atmos’ new banking model leverages bank deposits to exclusively finance climate-positive infrastructure. They are first enabling utility scale solar power, but will enter the market soon with low-cost loans for residential solar, electric vehicles and regenerative agriculture.

Atmos has removed all reasons not to align your deposits with climate solutions. All Atmos accounts are FDIC-insured and protected by state-of-the-art security. Customers are offered market leading rates and rebates and no-fee banking through an intuitive customer-focused digital experience.

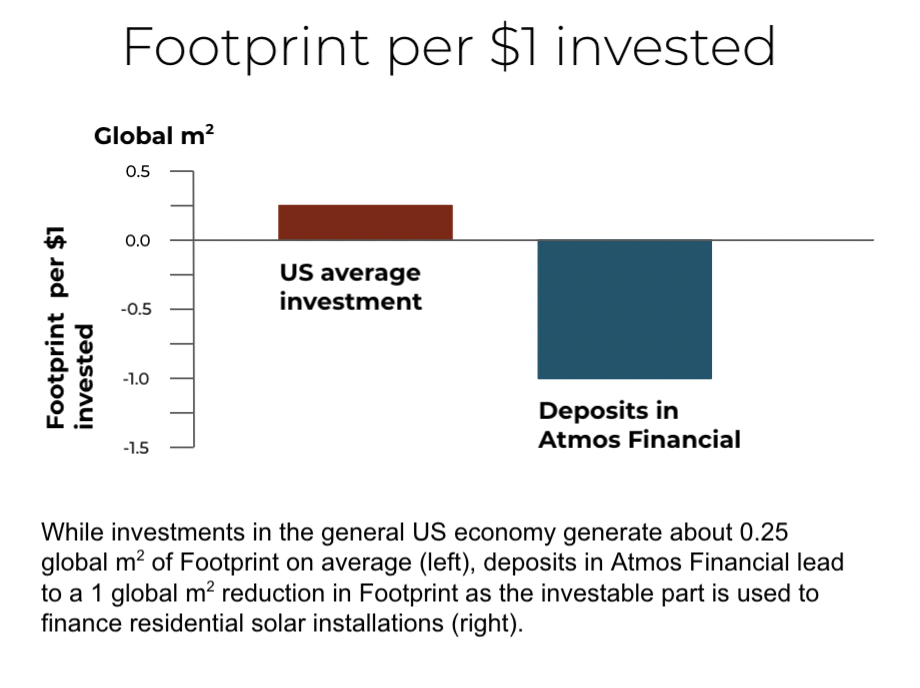

Resource intensity of conventional investments: Conventional assets are resource intensive. In the US, every dollar of investment leads, on average, to an increased production Footprint of about 0.25 global square meters (or $10,000 of assets come with 0.25 global hectares of production Footprint). This is calculated by comparing the sum of all US assets to the production Footprint of the US. There is considerable variation within investment possibilities.

Resource intensity of Atmos deposits: For every dollar deposited with Atmos, they’ll reduce the US production Footprint by about 1 global square meters by financing utility scale and residential solar electricity production. This reduction is equivalent to about saving 0.5 pounds of CO2 every year. We assessed the reduction based on US-EPA estimates, and also noted that banks are generally using about 80% of their deposits for lending (the remainder is held as cash reserves).

In other words and as sown in the figure on the left, rather than adding 0.25 global m2 of Footprint, deposits with Atmos actually SUBTRACT 1 global m2 from the American production Footprint as they finance residential solar. Most people have bank accounts. Keeping your liquid deposits with Atmos helps reduce emissions across the system.

Ecologically better, but at what financial cost? Atmos not only improves the ecological performance of deposits, it also makes the proposition financially attractive to its clients. Their FDIC-insured Atmos savings accounts both produce a better world, and pays a higher savings rate than conventional banks typically offer. Atmos is currently only available within the US, but hopefully we’ll see similar offerings available around the world soon.

Disclosure: The assessment of the difference between conventional deposits and Atmos deposits was produced by researchers of Global Footprint Network in collaboration with Atmos officers. Also, as part of the partnership between Atmos and Global Footprint Network, Atmos will donate $20 to Global Footprint Network (time limited) for every new customer gained using this link to help build more momentum for the many climate solutions at our fingertips.

There’s no benefit in waiting!

Acting now puts you at a strategic advantage in a world increasingly defined by ecological overshoot. Countless solutions exist that #MoveTheDate. They’re creative, economically viable, and ready to deploy at scale. With them, we can make ourselves more resilient and #MoveTheDate of Earth Overshoot Day. If we move the date 6 days each year, humanity can be out of overshoot before 2050.